At some point in their unique schedules, people will need to borrow funds. And while some has a pal or friend that is eager and capable lend the required amount, this is not constantly your situation. Furthermore, racking up credit debt or utilising the equity at home by placing another mortgage from the house commonly constantly practical alternatives.

In these instances, many individuals look to Personal Loans and/or payday advance loan. We’ve place both of these different financing in identical sentence. But’s important to note their unique vital differences — specifically before signing the label to nothing.

When you look at the following sections, we’ll go over exactly what unsecured loans and payday advance loan is. We’ll also touch on the advantages and downsides of every and gives suggestions for those presently dealing with scenarios where they need to borrow funds.

Exactly What Are Unsecured Loans?

Unsecured loans can be flexible and may be utilized for multiple needs — from debt consolidating and paying healthcare costs, to repaying pals or families or handling income tax debt.

A Personal Loan might acquired from a credit union, lender, or web lender. No collateral is required for Personal financing. However, you will have rigid words, such as simply how much the payment will likely be, just what rate of interest you are going to pay, and the time frame you’ll must repay what you’ve borrowed.

In some instances, origination charges may apply. These are generally between 1per cent and 8per cent on the overall levels you are taking out as your financing. To give an example, should you acquire $10,000 from a bank as your own mortgage, the amount energized for your origination fees will be between $100 and $800.

Unsecured loan Pros and Cons

Unsecured loans posses pluses and minuses. Let’s examine both:

What Exactly Are Pay Day Loans?

Payday advance loan get their identity from proven fact that lenders normally mean individuals to repay these financing each time they get their after that salary. Thus, it’s really no shock that payday advances generally bring brief payback periods.

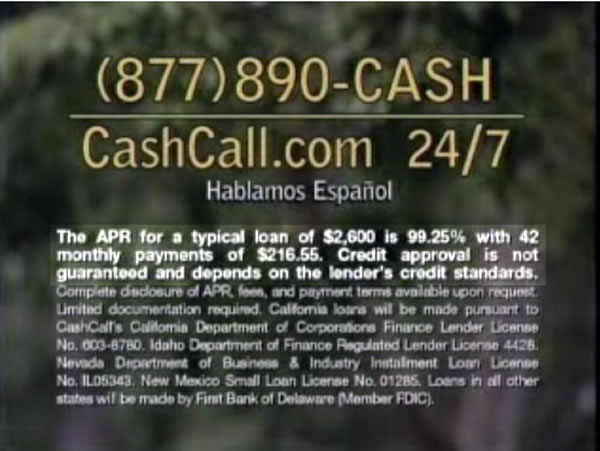

Another quality of pay day loans is their generally higher rates of interest. These loans are often wanted when individuals are located in a pinch, and loan providers know it. Consequently, they’ll hike within the interest levels and financial on borrowers not concentrating on that reality.

Individuals generally need to have the revenue overnight and do not have many options.Generally speaking, payday advances may either become acquired at brick-and-mortar locations or on the web. One advantage that lots of individuals fancy would be that credit checks aren’t part of the “application” procedure. Thus, if you don’t have a good credit score and want money immediately, it’s an alternative.

Payday advance loan Benefits And Drawbacks

Today let’s talk about the professionals and downsides of payday advance loan:

Were Personal Loans or Pay Day Loans Best For Your Needs?

Requiring one more sum of cash on relatively brief see isn’t an unusual predicament to obtain yourself in. You should not fundamentally think uncontrollable of one’s finances if this scenario happens along with you. Issues take place.

Nonetheless, you’ll  want to begin discovering the right sorts of mortgage to suit your scenario. Payday Loans can be usually a predatory types of financing. They desired those people who are more likely to get into a cycle of loans they can never ever get out of, therefore wouldn’t like that are you.

want to begin discovering the right sorts of mortgage to suit your scenario. Payday Loans can be usually a predatory types of financing. They desired those people who are more likely to get into a cycle of loans they can never ever get out of, therefore wouldn’t like that are you.

A far better option is to focus on your own financing. They are sound options for individuals, couples, and people which merely require a financial leg-up but they are also capable sensibly take care of repayments — also enhancing her credit score rating along the way. Programs can be carried out physically at an area part or online. If you are contemplating taking out a Personal Loan, speak to your neighborhood standard bank regarding your choices now.

At Carolina depend on government credit score rating Union, we all know that sometimes, you will need slightly extra money for expected and unanticipated existence events, and now we have it. Whatever it may possibly be, don’t worry— we’ve got that loan for the.